CKI-Led Consortium Signed Agreement to Buy

HK$20b North of England Gas Distribution Network

31 August, 2004 -- Hong Kong

A consortium led by Cheung Kong Infrastructure Holdings Limited ("CKI") has entered into an agreement with National Grid Transco PLC ("NGT") to buy the North England Gas Distribution Network ("NEG"), following a successful bidding process.

CKI holds 69.8% of the consortium vehicle, while the remaining interests in the consortium are held by United Utilities PLC (15%) and the Li Ka Shing (Overseas) Foundation (15.2%).

The total consideration for NEG is GBP1.393 billion (approximately HK$20 billion). It is to be funded by shareholder equity as well external bank borrowings.

Completion is expected to take place on 1 April 2005 when all conditions, including government regulatory consents are obtained. Prior to completion, it is CKI's intention to on-sell part of its interest in NEG so that its interest will be less than 50%.

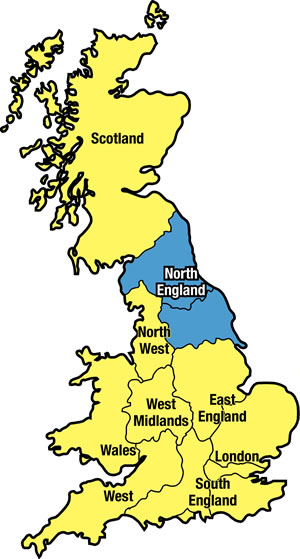

NEG is one of the 8 major gas distribution networks in the United Kingdom. Its network extends south from the Scottish border to South Yorkshire, containing a mixture of large cities (Newcastle, Middlesborough, Leeds and Bradford) and a significant rural area including North Yorkshire and Cumbria. It comprises approximately 36,000 km of distribution gas mains, with a total gas demand of 94 TWh. The network serves a total population of 6.7 million.

Mr H L Kam, Group Managing Director of CKI, commented: "We are pleased to announce that an agreement has been reached for the acquisition of this premium gas asset. NEG is expected to bring attractive cash yields to CKI."

"This represents our fourth international acquisition this year, following the acquisition of a 49% stake in AquaTower in Australia; the acquisition of 100% of Cambridge Water in the United Kingdom; and the acquisition of a 40% stake in the Lane Cove Tunnel in Australia," expressed Mr Kam.

"It is CKI's strategy to utilize our strong capital resources and proficient project management skills to fuel growth through acquisitions and we will continue to aggressively extend the reach of our business this way. Subsequent to the acquisition of NEG, our cash position remains strong and we are well-placed to continue to pursue investment opportunities," continued Mr Kam

"Following our success in Australia and China, it is our plan to expand our business in other countries worldwide and the United Kingdom is one of our prime markets. This investment in NEG will provide momentum for our expansion and diversification in the United Kingdom after the acquisition of Cambridge Water earlier this year. We now hold a sizeable portfolio in the United Kingdom which will act as a springboard for future investments and growth," Mr Kam said.

"The acquisition also highlights CKI's strategy of industry diversification and enriches our gas portfolio. In addition to transport, electricity and water, we expect gas to become one of the Group's core businesses," Mr Kam stated.

"While on one hand, we will continue to pursue infrastructure investment opportunities in Australia, China and the United Kingdom, efforts will also be made to explore new projects in new markets such as those in the rest of Europe and North America," Mr Kam concluded.

About CKI

CKI is the largest publicly listed infrastructure investment company in Hong Kong with diversified investments in Energy Infrastructure, Transportation Infrastructure and Infrastructure Related Business. Operating in Hong Kong, Mainland China, Australia, the United Kingdom, Canada and the Philippines, it is a leading player in the global infrastructure arena.

North of England Gas Distribution Network (NEG)

NEG is one of the 8 major gas distribution networks in the United Kingdom. Its network extends south from the Scottish border to South Yorkshire, containing a mixture of large cities and a significant rural area. It serves a population of 6.7 million people.

| Total population | 6.7 million |

| Total gas demand | 94 TWh |

| Total length of gas mains | 36,000 km |

- End -